An Evaluation of the Modern Scuba Diving Training Industry

What are the strengths and weaknesses of the scuba diving training industry?

The aim of this article is to take a look at the modern scuba diving training industry and hopefully induce some debate on what’s right, and wrong, with the current state of affairs. The goal is not to empower ‘agency bashing’, which is inevitably negative and benefits nobody. I accept that the nature of the dive industry varies in different locations and this will lead to a wide range of opinions and perspectives. I have tried to make my evaluation as ‘global’ as possible.

Leisure, or recreational, scuba diving has evolved over the decades. A half-century ago it was the preserve of only those with the dedication and motivation to seek hard-to-find training or work it all out for themselves. Certification courses were significantly longer and quite demanding.

Instructors were hugely experienced and often initially learned diving during military service. As the years have passed, the diver demographic has become more popular and ‘mass market’. Scuba training, equipment, and diving services have become extremely accessible, more economical, and more accessible around the globe.

The scuba diving training industry grew to a mass market

Mass-market scuba agencies grew and strove to enable a wider demographic of people to experience and enjoy scuba diving. However, those agencies achieved that goal by making diver training more convenient, quicker, and cheaper.

The success of shorter, less demanding, diver training courses inevitably leads to lower-quality scuba diving education. That, in turn, impacts diver retention and involvement in the activity. It impacts negatively on dive center profitability, instructor retention, professional job satisfaction, and dive professional salary expectations.

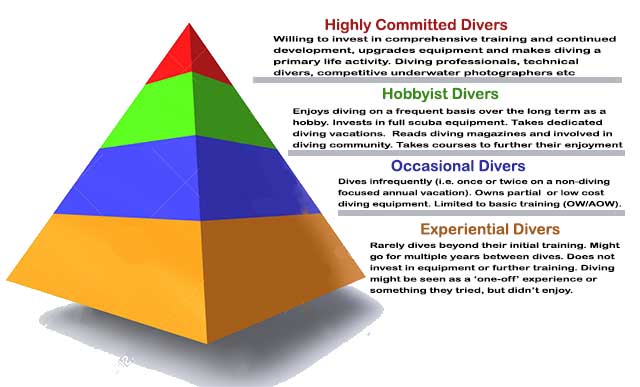

A spectrum of diver participation demographics

The illustration, below, indicates a range of diver demographics through their goals, participation, and commitment to scuba diving:

Experiential divers

The large foundation of the diver demographic is ‘experiential’ divers. These divers might conduct dive training as a one-off ‘bucket list’ experience, may not be sufficiently motivated to dive even occasionally or, otherwise, have significant restrictions on their opportunity to dive.

Occasional divers

Above them are the ‘occasional’ divers – those who do enjoy the sport, but are not sufficiently motivated to make it a part of their normal lifestyle. These might include vacation-only divers. Many will buy rudimentary scuba equipment, but it will spend months or years in storage between uses.

Serious divers

A smaller demographic is those scuba divers who seriously ‘get the diving bug’. These are the ‘hobbyist’ divers. They might typically equip themselves fully with the diving kit and have the opportunity and/or motivation to dive on a routine basis in their home location. They may venture into specialized activities, like underwater photography in a limited fashion, or even progress into teaching diving on a part-time basis.

Highly motivated divers

The smallest demographic is the ‘highly motivated’ divers, for whom scuba diving becomes a primary passion and a focus in their lives. These divers often specialize in niche activities, such as; technical, cave, wreck, professional/competitive underwater videography or photography and full-time dive instruction. Their disposable income and available free time may be highly focused on spending to sustain and develop their diving activities. Diving, or diving-related activities, may become their primary source of earning.

It is important to note that an individual may transition between levels of commitment to scuba diving as time progresses and the opportunities to dive vary. These opportunities will include their proximity to a diving area, the finances available to support their diving (at a given level), their health, and their life priorities; for instance, the competing demands of family or marriages.

Fixation on the biggest diver demographic

From the dive industry perspective, we can recognize that the higher in the pyramid, the higher the financial spend, per diver, is made on training, equipment, travel, and diving support services. However, a higher overall income stems from the base of the pyramid – the mass market sector dealing with experiential divers at the entry levels of diving.

From the diver training agency perspective, I don’t think there can be much more value from an ‘occasional’ diver, compared to an ‘experiential’ diver. Either is limited to potentially 1-2 training courses. That means 1-2 manuals/certifications sold. There’s little or no incentive for agencies to increase the scope and quality of diver training, aimed at developing diver retention and participation, to progress more experiential divers into occasional divers.

Indeed, increasing the timescale, cost, and challenge of diver training is highly likely to diminish the number of ‘experiential’ divers signing on for entry-level courses.

However, the wider scuba industry; dive shops, instructors, equipment manufacturers, diving travel agencies, resorts, etc etc etc, do receive more benefits from developing the commitment of divers.

The post-qualification financial spend as commitment increases is focused on equipment purchases and diving activity participation. Less so on training – until you reach the higher levels of diver participation, where the diver might start to develop long-term diving plans or ambitions. In this case, there is a distinct spike in their financial commitment to diving.

There is scope in the scuba training industry to focus on smaller demographics

What I assume, from a mass-market agency perspective, is that it is more profitable to expand the pyramid downwards than to try and develop divers upwards in the pyramid. Of course, they’d like to expand upwards, but not at the expense of increasing that profitable base level.

Thus, we have a conflict; whereby improved, higher quality, training empowers diver retention and commitment but simultaneously deters the vast majority of those who’d try diving only so long as it didn’t cost much, require much time, and/or was very easy to complete training.

Dive Industry Versus Agency Goals

One thing that the wider scuba industry needs to accept is that its goals might differ from those of the ‘big’ agencies. Experiential divers do little or nothing to bring profit to equipment manufacturers (beyond rental dive gear sold to dive centers). They do nothing to stimulate turn-over for dive travel businesses and very little to develop sustained turn-over for dive centers and instructor salaries.

Where big agencies do try to stimulate commitment from divers it is from ‘experiential’ divers. Those are people who wouldn’t try diving in the first place if the financial and personal commitment were higher. They are people who inherently don’t recognize or appreciate quality dive training.

The Power of Big Money Marketing

Attracting further revenue from those divers is only achieved through slick sales pitches, high-profile advertising, and clever branding.

It is achieved by:

- Forever dropping prices and requiring less commitment from students.

- Instructors focusing on diver training as a form of entertainment, rather than education.

It is not achieved by adding any intrinsic educational quality value to their diver training experience.

Mass-market scuba training agencies unashamedly target the lower demographic of diver commitment. That’s profitable for them if their turnover stems from the volume of certification cards and training materials sold.

Beyond that, all responsibility for developing diver commitment is passed to the scuba industry – to the dive centers and instructors.

The scuba diving training industry loves ‘loss leader” business models

Some agencies promote the notion of a loss-leader business model to dive centers/instructors. This is the illusion that the dive shops should sell initial scuba diving training cheaply to initially attract students and then recoup profitability from equipment sales, travel, vacations… and continued diver education.

In the age of cheap online equipment and travel sales, the loss-leader model is a non-starter. Desperate businesses generate desperate, or even disingenuous, salespeople and this does not benefit divers or promote long-standing trust and respect between the dive center and the customer.

Continued diver education is merely a continuation of the loss-leader model because those divers you’ve attracted with cheap, convenient courses will naturally always continue to demand cheap, convenient courses throughout their continued education. There’s no expectation of management from within the industry. Demand always seems to dictate supply.

The scuba training industry caters poorly to committed divers

Of course, whenever we do have divers wanting to make a further commitment in their diving (rise the pyramid), the continuance of low-cost, convenient, but inevitably low-quality, training becomes a very de-motivating factor. It breeds substantial cynicism in diver training schemes, agencies, and the industry.

Divers who are motivated to seek further training expect to realize significant improvements in their competency and skill. Too often they do not. They may have been initially attracted to learn diving because of low costs, convenience, and the need to commit little time or effort; but they are alienated from seeking further training because those same factors now lead to disappointment.

The scuba diving training industry relies upon price-cutting

There is constant pressure to price-cut as the primary method of dive training industry competition. This doesn’t stem directly from the diving agencies, but neither do those big agencies take active steps to prevent it.

The practice originates from the desperate dive centers themselves, yet it is often not what they want to do. As the prices drop, the profit-per-student decreases. The only solution seems to be attracting more students. That, in turn, demands further dropping prices and making courses quicker, easier, and more convenient.

Cost-Based Competition in the Dive Industry

Price-cutting competition happens only when customer value appreciation is focused on the ‘certification cards’ they are issued; and not on the quality of training that they receive. Price competition occurs when everyone is perceived as selling the same quintessential ‘product’. That product is ‘diving licenses’, not diving training.

So, the wider scuba diving training industry fights to attract experiential divers. Then it struggles again to turn them into ‘occasional’ or ‘hobbyist’ divers. Scuba diving training providers are led to believe that ‘converting’ or ‘up-selling’ experiential divers into hobbyist divers is how the business should work.

I’m not sure it works like that.

I don’t think that many divers get ‘converted’. There’s always a demographic that’d become occasional divers. A smaller demographic that’d become hobbyist divers. A small fraction that’d become highly committed divers.

When I started diving, I was an ‘occasional’ diver. I loved diving from the very start, but I didn’t have the time and money to increase my commitment until several years later. What empowered me to get more serious about diving was a divorce, not anything done by an agency or instructor. No amount of marketing, branding, or instructor sales pitch could have changed that situation.

I am sure many occasional divers are like that. They are inevitably constrained by time, money, and opportunity limitations.

Targeting the Lowest Investment Demographic

Dive centres and instructors are influenced to target experiential divers and then it’s those training providers who get the blame for not expanding the commitment of their student divers.

How are they influenced? Take a look at the incentive and recognition ‘schemes’ that some agencies use to reward dive centers, instructors, and instructor-trainers exclusively for high volumes of student turnover. The focus on quantity, rather than quality, of diver education provision, is as obvious as it is insidious.

Of course, when the magic fails to happen and all those experiential divers don’t become hobbyist divers, then dive businesses can fail. Especially when the economy and tourism takes a dive.

So, if you can’t beat them, join them. Dive centers are compelled to abandon any idea of quality diver education and ‘go with the flow’. They start focusing all of their profitability hopes on doing anything to develop a maximum turn-over of experiential divers.

Inevitably, there are winners and losers.

The rise of ‘sausage factory’ scuba diving training

The result is ‘successful’ sausage-factory dive centers. Big sales pitches, low prices, insubstantial training, and low-quality scuba diving training at every level from OW to the instructor and beyond.

In these cases, the battle between quantity versus quality has been decided. It results in a very high turnover of divers, allowing larger dive centers and more instructors employed.

But because of the low-cost point of scuba training courses, those instructors actually earn little to nothing for all their hard work. Neither are they personally satisfied with their work. They became divers, and instructors, due to their love of the underwater world; but are inevitably frustrated with the quality of divers they are ‘permitted’ to produce.

Their time in the scuba industry is consequently limited. Instructor retention is very low. One cannot possibly make scuba instruction a lifetime career without a sufficient income to support the long-term costs of families, children in college, saving for pensions, etc.

We are now in the era of ‘experiential dive instructors’. Students who are expertly sold onto ‘zero-to-hero’ training to pro level; in extremely short time-scales and without the need to accumulate any significant expertise or experience. ‘Professionals’ who dive (and teach!) for only a year or two before discontinuing active, frequent participation in scuba diving. It’s not logical.

The scuba diving training industry suffers from terrible expertise retention

There are very, very few full-time diving instructors who make a true ‘career’ in the diving industry. The experience drain is overwhelming and benefits nobody.

Of the very few instructors who maintain active teaching status beyond a couple of years, most are either part-time instructors with another primary income (full-time non-diving employment or a pension), become dive center owners themselves, or operate independently in very specialized areas of diving (technical, cave, etc).

Mistakes in recreational dive training are migrating to technical and rebreather levels

The same dilution from ‘highly committed’ to ‘experiential’ diver demographics is starting to occur in technical and CCR diving. Previously niche markets exclusively consisted of ‘highly committed divers’; you now see experiential or occasional tech and CCR divers.

The type of divers who rush through training levels to mixed gas decompression diving, then only get wet once or twice a year. The type of divers who view technical diving training as just another specialty card to collect. Only in the last few years have I encountered technical divers who don’t even own their own diving kit.

Mass-Market Dive Industry Motivations

Mass-market diving motives have reached the technical diving community and turn-over-focused dive centers or instructors cannot resist the opportunity to increase their turn-over by offering a ‘wider range’ of experiences for their customers to enjoy.

There are niche diving agencies, especially those with their roots in the elite cave and technical diving, which aim exclusively for the upper demographics. They typically attract divers who enter the system with early intentions of undertaking advanced-level, serious diving. They see value in the ‘beginning with the end in mind’ philosophy and are willing to commit heavily to training in terms of time, money, and motivation.

These agencies have certainly been successful in the last two decades in promoting a concept of what a ‘skilled’ scuba diver should be. Those expectations; initially evolved in the technical or cave communities have trickled down into the recreational community to a limited degree.

At present, I’d suggest that the limit was to those ‘hobbyist’ recreational divers who seek knowledge on internet diving forums and/or are located in areas where they may be influenced by observing cave or technical divers.

The Prestige Motivated Diver Demographic

More recently, there is also a new demographic of divers who attribute a ‘designer brand’ label to those cave diving agencies. It’s more expensive and more exclusive – so, therefore, it is more attractive. They don’t particularly care about the quality of education but place a value on the diving ‘prestige’ to which they become associated.

These aren’t the ‘highly committed divers’ in the traditional sense, but rather they are ‘the best that money can buy‘ divers. Needless to say, this demographic consists exclusively of divers who do not suffer financial constrictions in their investment in expensive training and equipment.

The demographic the scuba training industry ignores the most

So, we’ve covered the top of the pyramid (niche agencies) and the bottom of the pyramid (mass market agencies). It’s much harder to identify any agency that actively or primarily focuses on the middle of the scuba diving training pyramid.

Where is the mid-demographics agency that provides consistently good quality training at a reasonably moderate price? Where is the training sufficient to empower sustained diver retention and not willing to lower standards to appease/attract those who probably aren’t going to stimulate turnover beyond their initial experience?

It seems to me that agencies are compelled to either focus on the elite, or the masses… and nothing in between.

That’s odd because, in most other consumer industries, there is a spectrum of suppliers who target specific demographics. You can buy cheap cars, mid-range cars, and elite cars. Budget clothes, high-street fashion, and high couture. McDonald’s, Steakhouse, and Michelin Star…

The Need for Mid-Market Dive Training Agencies

I do believe that there is room in the market for a mid-level agency that focuses exclusively on hobbyist-level divers. An agency that provides comprehensive initial training, along with a continuing education program that matches increasing diver commitment with increasingly robust training courses; appropriate for advancing students having higher result expectations.

The alternative would be for existing ‘big’ agencies to re-model their continuing scuba diving training education programs beyond the entry level. Reflecting a possibility that encouraging diver retention and investment in further training can be attributed to shaping diver training expectations.

Accepting that divers who are willing and able to commit more time, effort, and finances to their diving development are also likely to expect a higher level of training and consequent tangible results.

About The Author

Andy Davis is a RAID, PADI TecRec, ANDI, BSAC, and SSI-qualified independent technical diving instructor who specializes in teaching sidemount, trimix, and advanced wreck diving courses.

Currently residing in Subic Bay, Philippines; he has amassed more than 10,000 open-circuit and CCR dives over three decades of challenging diving across the globe.

Andy has published numerous diving magazine articles and designed advanced certification courses for several dive training agencies, He regularly tests and reviews new dive gear for scuba equipment manufacturers. Andy is currently writing a series of advanced diving books and creating a range of tech diving clothing and accessories.

Prior to becoming a professional technical diving educator in 2006, Andy was a commissioned officer in the Royal Air Force and has served in Iraq, Afghanistan, Belize, and Cyprus.

In 2023, Andy was named in the “Who’s Who of Sidemount” list by GUE InDepth Magazine.

Purchase my exclusive diving ebooks!

Originally posted 2018-11-05 06:10:42.